3 Ways to Get Creative with Paying Closing Costs

You finally found your dream home and are ready to start down that road to homeownership. It’s such an exciting time! … But then there are the fees. Underwriting fees, application fee, origination fees, recording fee, appraisal fee, and many others. Closing costs include so many fees that you may start to wonder if you’re really as ready to buy a home as you thought you were.

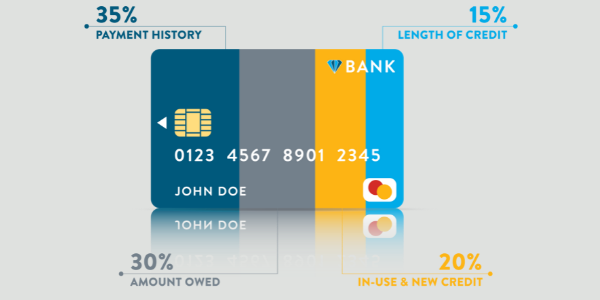

How Your Credit Score is Calculated

You know credit scores are important, but you may be wondering how they are calculated and what the big deal is. This all-important number can be looked at for a multitude of reasons: when you get a job, lease an apartment, open a new account, or apply for a loan—including a home loan.

Mortgage Interest Rates:

Float vs. Lock Strategies

It’s an age-old question, at least when it comes to mortgage interest rates: Is it better to float your rate or lock in your mortgage? There are pros and cons to each, which can vary based on the overall economy, as well as unpredictable factors that can cause rates to go up or down.

What is a Good Credit Score to Buy a House?

Before you go too far down the house-hunting rabbit hole, you’ll want to make sure you can qualify for a home in the price range you want. Though many factors go into this, your credit score is definitely one of them!

Understanding When You Need

a Jumbo Loan

Jumbo loans. Their name kind of hints at their function. The jumbo loan program is designed for loan amounts that exceed the conventional conforming loan limits of the Federal Housing Finance Agency (FHFA). In other words, they’re big loans. Some might even call them “jumbo.”

4 Ways to Use Your Home Equity

You may be asking yourself how best to put your equity to work for you. One option, of course, is to leave it alone and reap the rewards when you eventually sell. For many of us, however, there are good reasons for tapping into it now.

3 Things You Can Do to Prepare to Buy a Home

Interest rates are still attractive, and inventory is creeping up, which means now is a great time to jump into the housing market! Here’s the thing, though. While “Zillowing” has become one of America’s favorite pastimes, actually buying a home isn’t as simple as jumping into the market. Unless you’re a cash buyer. In which case, bravo to you!

4 Reasons to Build an ADU

An accessory dwelling unit, or “ADU,” is a fancy phrase for a smaller stand-alone space on your property. They’re oftentimes referred to as guest houses, granny flats, or even pool houses. These modest spaces are functional, livable, and super convenient if you need more room but don’t feel like packing up and moving into a new home entirely.

What You Need to Know About Getting a Mortgage When Self-Employed

Being self-employed can be amazing! To many it sounds wonderful—you get to be your own boss, set your own hours, and work from anywhere! As many who are self-employed know, it’s not as simple as that (long days, making payroll, and no steady paycheck). There are many perks to entrepreneurship, including that invigorating feeling of creating a business, but some people worry that this path will make it difficult to qualify for big-ticket purchases like a home.

BUYING A SECOND HOME

Second Home v. Investment Property

You have your primary residence, but you’re thinking about buying a second home. Congrats! Being in a position to purchase another residence is a major accomplishment, and you should be proud of that.

The first thing you’ll want to do after celebrating your awesomeness is determine the function of this home. There are second homes that are exactly that—additional dwellings regularly used by you and your family. Then there are investment properties that are purchased with the explicit intent of renting them out as a source of income.

There are a few differences between a second home vs. an investment property. They can impact your interest rate, down payment, ability to qualify, and even taxes. So make sure you’re clear on the goals for this property from the start.

Pre-Approval Can Add Certainty

We’re all searching for a little certainty nowadays. At a time when it seems like everything is changing, you can at least buy yourself a little peace of mind in the homebuying process by getting pre-approved. Now, we know what you’re thinking: I have a steady job, savings for a down payment and relatively predictable monthly expenses. Do I still need a mortgage pre-approval? The answer is yes. can benefit from pre-approval.

7 Things to Consider When Buying & Selling Simultaneously

There may be no greater example of multi-tasking than when you’re buying and selling a home simultaneously. It can feel like you went from 0 to 100 in no time flat! Whether you’re chomping at the bit to get settled into your new home or ecstatic about the price you secured for your current home, we know you have plenty of activity to go around.

5 Things to Consider if You’re Thinking of Relocating

Relocating is on the minds of many Americans right now for a few reasons. These include the current work-from-home (WFH) culture spurred by COVID-19, career changes and low interest rates. Companies like Facebook, Google and Twitter have even given many employees the permanent option of working from home. This is causing change in our major cities as workers consider where they would want to live if their job’s location wasn’t a factor.

Things to Look for When Choosing Your New Neighborhood

Moving to a new neighborhood can be so exciting! You’ve got a new home to make your own, a neighborhood to explore and different amenities at your disposal. This is a brand-new chapter filled with endless possibilities!

Once that novelty wears off, however, you want to feel confident you’re just as happy with your new neighborhood as you were when you first drove by it.

So consider these four factors before you lay down your next set of roots in a new neighborhood.

What Paying Off Your Mortgage Could Mean For You

Is it smart to pay off your mortgage early? It certainly can be, in certain situations. In other scenarios, it may make more sense to put that money to work elsewhere, or to keep it in the bank.

The advantages of paying off your mortgage early can be vast. You’ll save money in interest, build equity quicker and pay off your home sooner. These factors equate to extra cash in your pocket, the option to utilize a home improvement loan and debt-free living – at least in terms of your home!